CELEBRATING 25 YEARS OF BUSINESS EXCELLENCE!!

TAX PREFERRED BENEFITS FOR BUSINESS OWNERS

What Is A Cost Plus Plan?

Cost Plus Plans provide TAX PREFERRED and COST-EFFECTIVE Health & Dental benefits for business owners!

Think of a Cost Plus Plan as a “little gold nugget” that has been offered to you by Canada Revenue Agency. All you must do is know what it does and how to use it. Thousands of business owners across Canada use their Cost Plus Plans every day to provide 100% coverage for their family health and dental benefits while being able to deduct 100% of the expenses through their companies! Win-win!

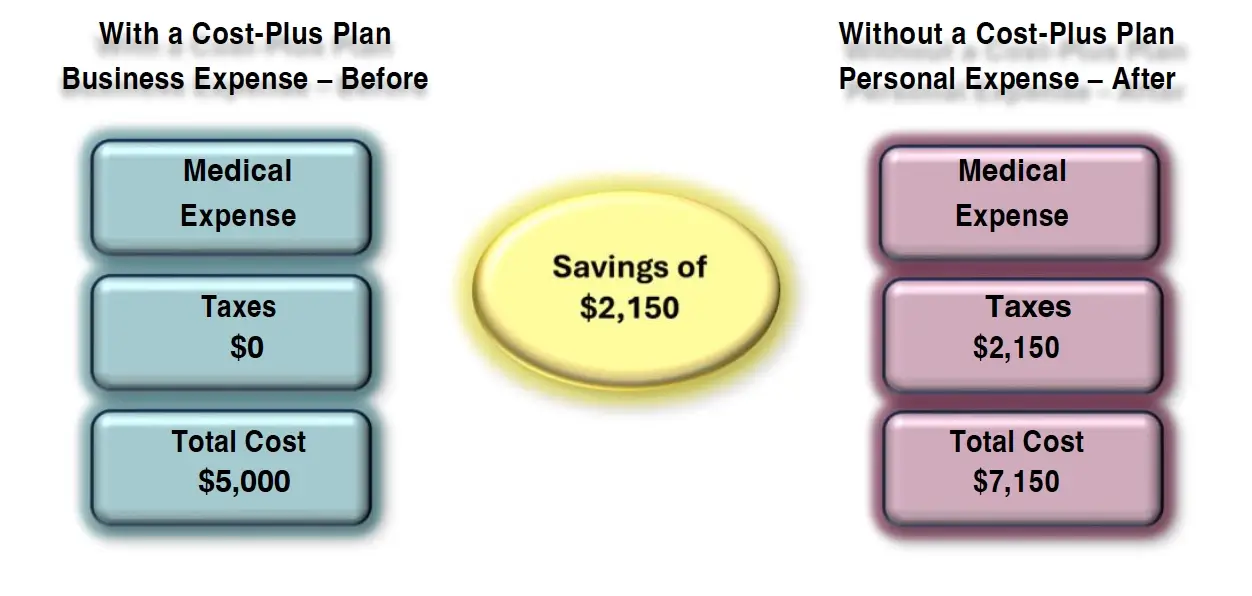

Let us explain to you in a comprehensive manner how you can experience approximately 30% savings using a Cost Plus Plan as opposed to paying premiums into a traditional benefit plan.

How Does A Cost Plus Plan Work?

A Cost Plus Plan allows for reimbursement of eligible medical and dental expenses which otherwise would have been payable by the individual with after tax dollars. A Cost Plus Plan usually replaces a standard medical or dental plan as a stand-alone program. It can also be offered as a component of a flexible benefit plan or as a complement to a traditional group insurance plan and can be used to offset any expenses that have not been covered under those types of plans.

Premiums for such a plan are deductible for tax purposes and the reimbursement to the employee for those services is a non-taxable benefit in accordance with Interpretation Bulletin 339R2 dated August 8, 1989, which reads as follows:

“Under a Cost Plus Plan, an employer contracts with a trusted plan or insurance company for the provision of indemnification of employee’s claims on defined risks under the plan. The employer promises to reimburse the cost of such claims plus an administration fee to the plan or the insurance company.” “Provided that the risks to be indemnified are those described in paragraphs (a) and (b) of the definition of ‘private health services plan’ in subsection 248 (1), such a plan qualifies as a Private Health Services Plan.”

In the above bulletin, “employer” refers to the Corporation and in CRA’s view, is a totally separate entity from you, even though you are the “active” owner of the company. Therefore, it makes sense that a Cost Plus plan could be implemented for the “owner” in the same manner that it would be for an “employee” that would be hired to do the same job as the owner.

The greatest advantage of a Cost Plus Plan is flexibility! Your plan allows you to choose what you want to use or what you need to use and when you use it. In addition:

All individuals are eligible regardless of pre-existing conditions, prior usage, or age.

There are no deductibles or co-insurance amounts - 100% coverage.

There are no limits for the number of visits and treatments per practitioner.

You determine how much or how little you will spend in any given year. Budget control and no creeping premiums!

What Is An Eligible Expense Under A Cost Plus Plan?

Canada Revenue Agency has made it very clear that the eligible expenses that qualify for reimbursement under a Cost Plus Plan would be the same expenses that would qualify under Medical Expense Tax Credit (METC). These would include Medical Prescription Drugs, Dental and Vision expenses. There are not a lot of limitations as to what is covered, so the list of practitioners, services, products, and appliances is quite extensive. Please refer to the General Guideline of Eligible Medical Expenses available on this website.

Premiums contributed to a non-government insurance plan are an eligible expense under a Cost Plus Plan. This could include the purchase of a stand-alone benefit plan, or even premiums paid into a spouse’s benefit plan through their employer.

Your Cost Plus Plan can also coordinate with a spouse’s plan to pay for any deductibles, co-insurance amounts, or unpaid expenses from their plan.

TAXATION CONSIDERATIONS OF A COST PLUS PLAN

A Cost Plus Plan qualifies as a PHSP, and any premiums paid to a PHSP by a company are considered business expenses and 100% deductible against business income.

All premiums paid and benefits received are 100% tax free to the recipient whether it is the owner of the company or its employees.

CRITERIA FOR IMPLEMENTING A COST PLUS PLAN:

A formal Private Health Services Plan (PHSP) agreement must be in place with a Third-Party Administrator (TPA) or Insurance Company.

Cost Plus Plans must be 100% funded through your company.

A Cost Plus Plan cannot be used to purchase additional insurance such as life insurance, Long-Term Disability or Critical Illness Insurance.

Benefits must meet income tax definitions of eligible expenses.

HOW DO YOU PAY FOR A COST PLUS PLAN?

Pay-As-You-Go:

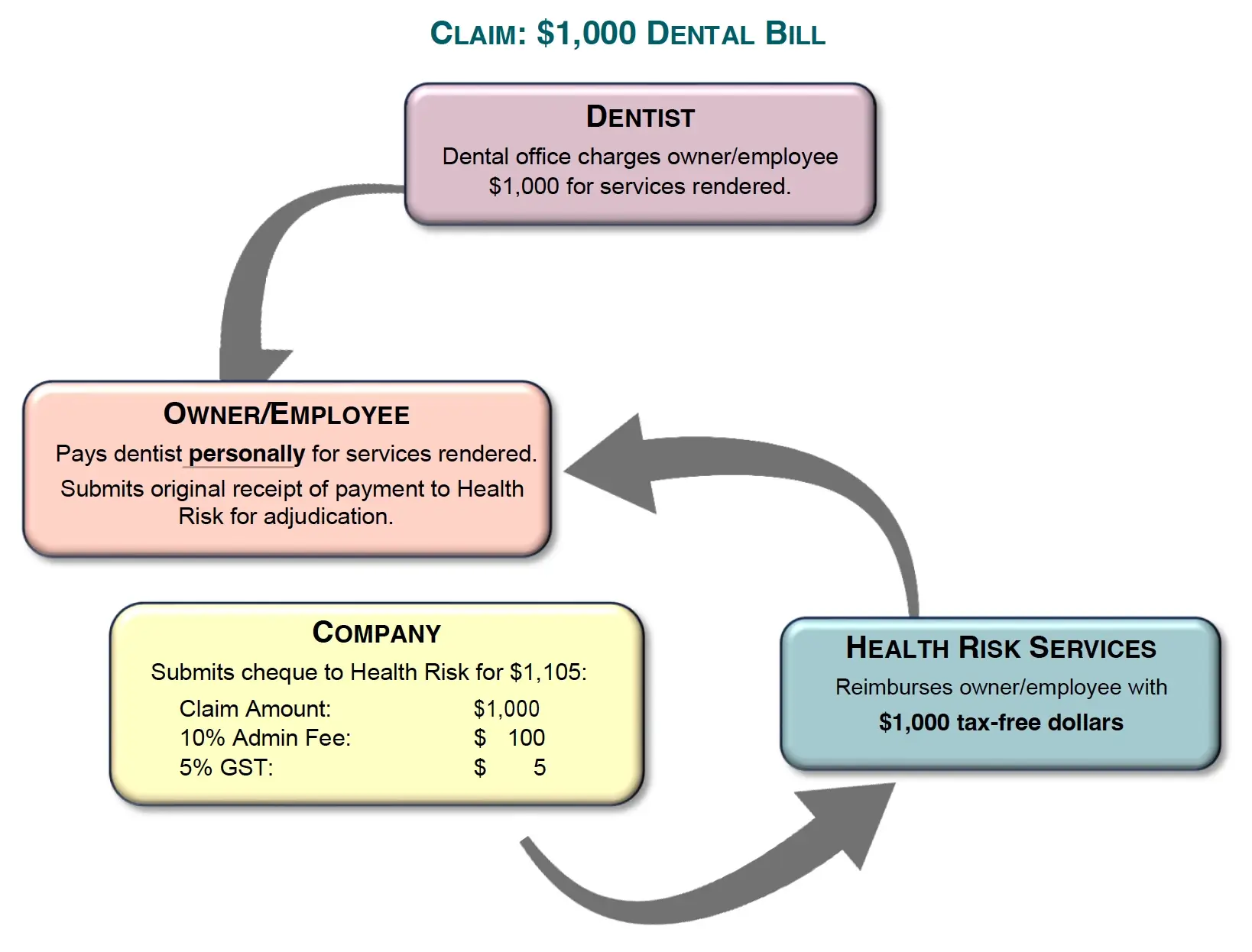

You submit your Cost Plus Claim Form along with your expense receipts to Health Risk Services. Your claim is adjudicated by our claim specialists to determine eligiblity and reimbursement. Your company will then receive an Invoice for the amount of the reimbursement due, plus the administration fee and GST. Once your company has paid the Invoice, Health Risk will reimburse you personally with your tax-free benefit amount.

Pre-Funded Plan:

Your company is Invoiced for the determined amount that you wish to use for “funding” your Cost Plus Plan. These funds are deposited into your plan Cost Plus Operating Account. The funds are then used to reimburse your claims as they are submitted avoiding any delays in processing. When your Operating Account is depleted, your company will once again be invoiced for additiona funding.

The following example merely demonstrates the process of making a claim with a Cost Plus Plan through Health Risk Services Inc. Variances will apply for every Plan registered and amounts and claim eligibility will vary from registrant to another. Numbers chosen are made for demonstration purposes only and are simplified to a greater extent than what an actual claim may present.

There is no formal plan in place, so you pay for all your medical expenses personally out of your pocket with tax dollars.

You implement a Cost Plus Plan in your business, which allows for 100% of all eligible medical expenses to be paid through your company.

According to the Canada Revenue Agency (CRA) Interpretation Bulletin IT-339R2 paragraph 6 states: “In a ‘Cost Plus’ plan, an employer contracts with a trusted plan or insurance company for the provisions of indemnification of employees’ claims on defined risks under the plan. The employer promises to reimburse the cost of such claims plans and administration fees to the plan administrator or insurance company. The employee’s contract of employment requires the employer to reimburse the plan administrator or insurance company for proper claims (filed by the employee) paid, and a contract exists between the employee and the trustee plan or insurance company in which the latter agrees to indemnify the employee for claims on the defined risks so long as the employment contract is in good standing. Provided that the risks to be indemnified are those described in paragraphs (a) and (b) of the definition of ‘private health services plan’ in subsection 248(1), such a plan qualifies as a private health services plan.”

The definition of a PHSP appears in subsection 248(1) of the Income Tax Act and a detailed CRA summary is provided in Interpretation Bulletin IT-339R2. The following statement outlines the type of expenses that must be covered by a PHSP.

“Generally, coverage under a PHSP must be for medical expenses that qualify under subsection 118.2(2) of the Act when determining the medical expense tax credit (e.g. amounts paid for prescription drugs or dental services). If a particular plan provides coverage for expenses other than those described in subsection 118.2(2) of the Act, the plan will not qualify as a PHSP.” (Reference: CRA Tax Interpretation Letter 2002-0165695.) For additional information on a PHSP, consult the Interpretation Bulletin IT-339R2, under the meaning of a ‘Private Health Services Plan’.

Cost Plus benefit payments are considered a non-taxable benefit for plan members if the Cost Plus plan qualifies as a Private Health Services Plan.

“Contributions made by an employer to or under a private health services plan on behalf of an employee are excluded from the employee’s income from an office or employment by virtue of subparagraph 6(1)(a)(i)” of the Income Tax Act.” For more information, refer to IT-339R2.

We CARE about insisting that your plan stays current with CRA guidelines

We CARE about providing you with all the proper plan implementation documents for your corporation to ensure compliance with CRA.

We CARE about ensuring quick turnaround times for your claims.

We CARE about providing you with the convenience of direct deposit for your reimbursements.

We CARE about ensuring you are kept up to date on any legislation changes that may affect your Cost Plus Plan.